In banking, customer service and fast support responses are extremely important for high customer satisfaction. What Is AI Prompter? And this is where AI Prompters are changing the way how financial institutions address these requirements. AI Prompters provide real-time assistance to customer service agents by using machine learning and natural language processing to suggest responses based on the customer query, transaction history and interaction context. This increases productivity and improves the personalization of every interaction to meet the demand that customers expect from banks. Do you want to learn more? Then keep reading! AI Prompter Helpful?

The Importance of AI Prompters in Banking .What Is AI Prompter?

Customer expectations in the financial industry have vastly spanned out. Customers now expect a speedy, precise and contextual response over digital and physical service touchpoints. Offering this kind of support is resource intensive for banks. This is why we have AI Prompters.AI Prompter Helpful?.

These systems allow your customer service team to respond faster to customer queries. They help to tune the tone of messages, act as search engines to search the internal documentation for the information and data and it can also help you to write a message without any efforts. Thebots are the answer to fulfilling modern age customer expectationsinsides of banking and catching up with the productivity demands of CS agents.

Elements that AI Prompters are Made of Top Features of AI Prompters Take a look below. What Is AI Prompter?

Immediate suggestions on responses—AI Prompters processes the responses in real-time and in a matter of seconds, it analyses the response and recommends some suggestions that the consultants can either choose to send it as-is, edit it or can expand it upon to suffice a human touch and to ensure some quick turnarounds in response times. With accuracy in mind, it scores these suggestions and only the ones absolutely relevant are presented to facilitate uninterrupted customer interactions.

Smart recommendations–The AI Prompters combine the customer data to individualize recommendations and responses. By exploring consumer data, banks provide solutions, products, or financial advice to meet individual customer needs and their financial history with banks, thereby increasing customer engagement and satisfaction.

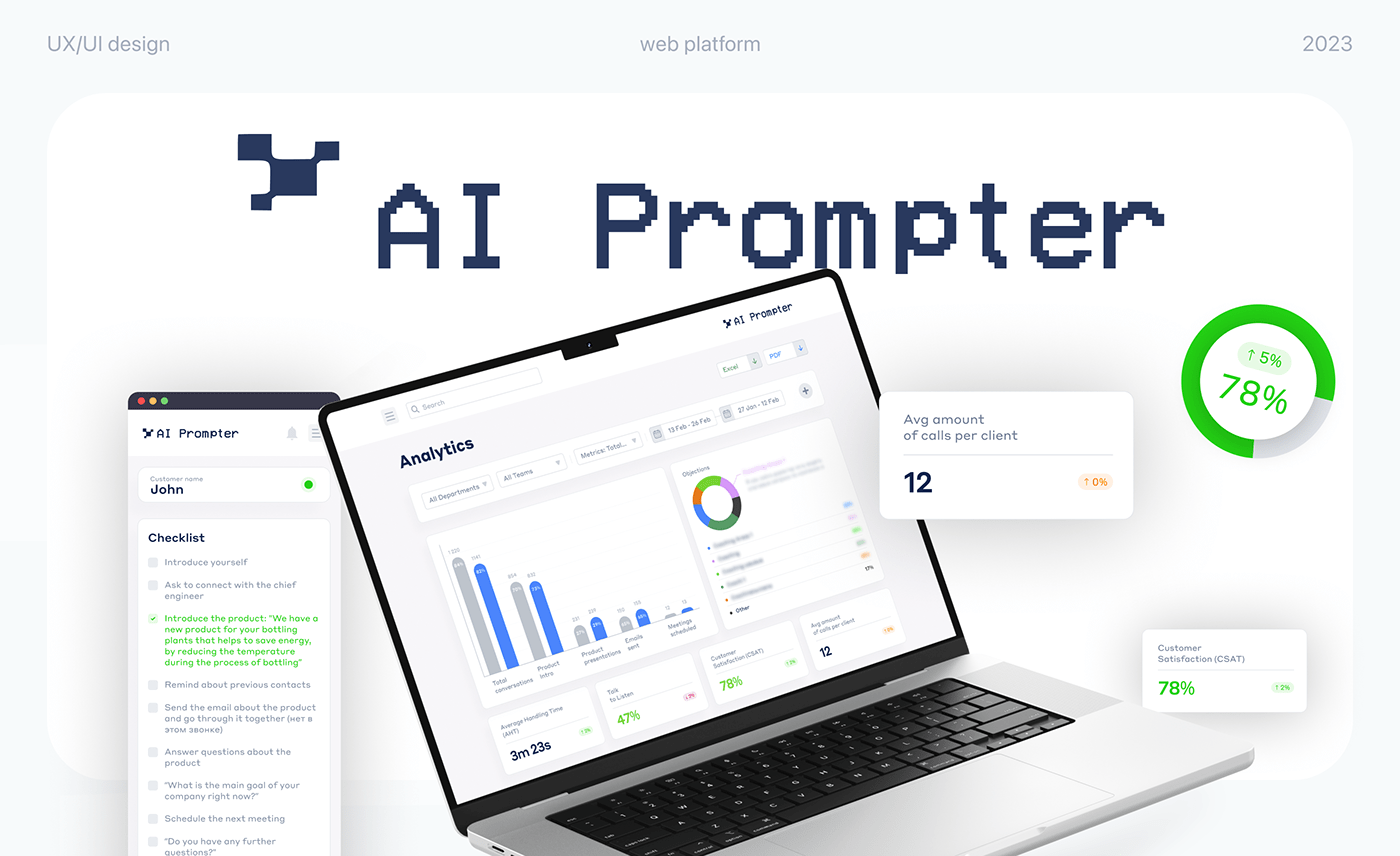

Flexible administration dashboard—These systems are built with a user-friendly dashboard to enable a bank administrator to create, modify, and reorder the response content as per the changing needs of the customer. This is needed to cater for new regulations, changes in the products themselves or changing customer demands without making changes to the core of the entire system.

Simplified Onboarding and Training—Because AI Prompters shoulder a majority of the query-related workload, they help lower extensive training needs, allowing new employees to achieve maximum productivity sooner. That’s especially helpful for banks that have been trying to ramp their customer service teams without the resources to do so.

Improved compliance and security — It is imperative for banks and other regulated sectors that responses do not conflict with compliance obligations. Plus, AI Prompters can be set up to honour regulatory requirements, flagging up answers that might need particular caution or attention from specialist departments.

The Takeaway

AI Prompters provide automation in the customer experience while being personalized. It enables your agents to fetch correct answers & real-time data insights. Hence, banks can almost rely them on blindly to satisfy their customer demand and eventually earn a big chunk of competitive advantage. So we encourage you/your organisation to roll them out as soon as you can.